parker county tax assessment

Serves as president of the Property Tax Assessment Board of Appeals which hears property tax assessment appeals. The median property tax on a 14710000 house is 245657 in Parker County.

Property Tax Information Sussex County

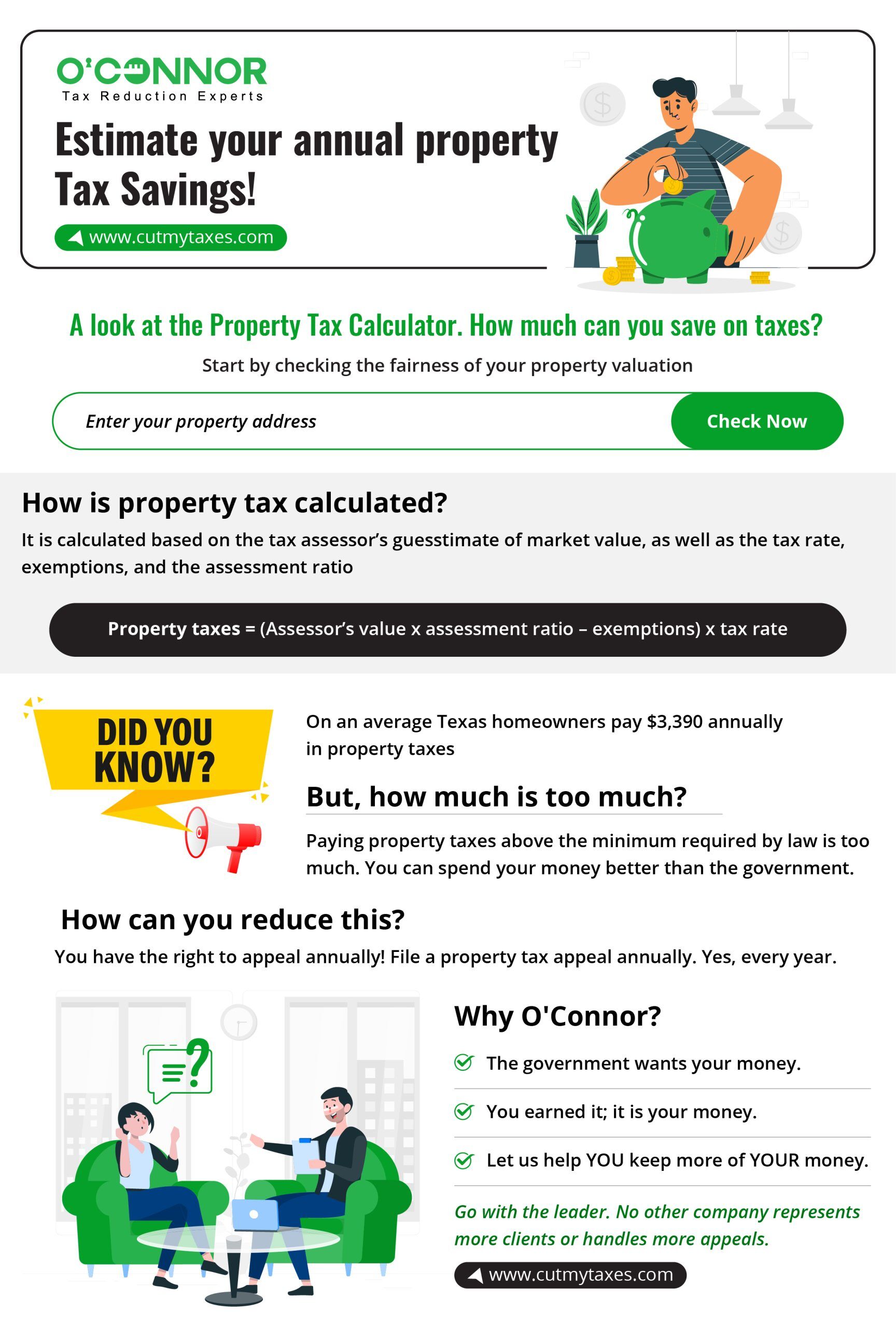

Check out some of the popular property tax reduction consulting services in Parker County Texas.

. Oconnor is the leading company representative for the Parker County Appraisal District property owners because. Parker establishes tax levies all within the states constitutional directives. Change of Address on Motor Vehicle Records.

Find Parker County Tax Records. Parker County is the entity that evaluated the property and it will consider your protest. For over 20 years OConnor has provided property tax consulting services in the Parker County Appraisal District and has continuously produced results.

Box 2740 Weatherford TX 76086-8740 Telephone. County tax assessor-collector offices provide most vehicle title and registration services including. The present-day market worth of real estate situated within Parker is computed by county assessors.

For more information please visit Parker Countys Central Appraisal District and Treasurer or look up this propertys current tax situation here. Oversees a general reassessment in the county. The Douglas County Assessors Office makes no warranties either expressed or implied concerning the accuracy or completeness of the data presented on this website for any other use and assumes no liability associated with the use of this data.

The Parker County Tax Assessor is the local official who is responsible for assessing the taxable value of all properties within Parker County and may establish the amount of tax due on that property based on the fair market value appraisal. Public Property Records provide information on homes land or commercial properties including titles mortgages property. Looking for Property Tax Protest Experts in Parker County TX.

These records can include Parker County property tax assessments and assessment challenges appraisals and income taxes. However left to the county are evaluating property issuing assessments taking in the levies engaging in compliance measures and clearing up discord. Non-fee License Plates such as Purple Heart and Disabled Veterans License Plates.

Ad Find County Online Property Taxes Info From 2021. A sample of the Notice of Assessment of Land and Structures - Form 11 and a letter to Parke. Courthouse Annex 1112 Santa Fe Dr Weatherford TX 76086-5855 Mailing Address.

1108 Santa Fe Dr Weatherford Texas 76086. Parker County Property Records are real estate documents that contain information related to real property in Parker County Texas. Inheritance tax appraiser for the county.

Parker County Stats for Property Taxes Explore the charts below for quick facts on Parker County effective tax rates median real estate taxes paid home values income levels and homeownership rates and compare them to state and. The Parker County assessors office can help you with many of your property tax related issues. OConnor is the most aggressive property tax consultant.

By clicking on a result in the search you acknowledge that you accept this disclaimer. Parker County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Parker County Texas. Unsure Of The Value Of Your Property.

If you have reason to think that your real estate tax value is excessively high you can always protest the valuation. For comparison the median home value in Parker County is 14710000. Town of Parker 20120 E Mainstreet Parker CO 80138 Phone.

The Parke County Assessor is responsible for the following functions. 817 598-6133 Email Address. Registration Renewals License Plates and Registration Stickers Vehicle Title Transfers.

The documents you require and the procedures youll comply with are kept at the county tax office or on their website. If you need to find your propertys most recent tax assessment or the actual property tax due on your property contact the Parker County Tax Appraisers office. Find All The Record Information You Need Here.

PARKER COUNTY COMMISSIONERS COURT APPROVES EXTENSION OF FIREWORKS PROHIBITION FOR 60 DAYS. Parker County Assessors Office Services. Jenny Gentry Physical Address.

Parker County Commissioners Court approves extension of fireworks prohibition for 60 days through September 6. Parker County Appraisal District.

Property Tax Assessment Alabama Department Of Revenue

Scam Alert Fraudulent Tax Letters Claiming Distraint Warrant Cattaraugus County Website

Exemptions To Property Taxes Pickens County Georgia Government

File A Protest If Your Residential 2022 Property Taxes Are High

How To Lower Your Property Taxes In Texas

Law Amends Property Assessed Clean Energy Pace Programs In Virginia Jd Supra Assessment Renewable Energy Energy

Dallas County Homeowners Successfully Protesting Massive Property Tax Assessments

A Guide To Your Property Tax Bill Alachua County Tax Collector

Property Tax Assessment Alabama Department Of Revenue

Property Tax Assessment Alabama Department Of Revenue

Cs Executive Introduction To Direct Tax Income Tax Property Tax Online Taxes Income Tax Tax

Get Best Tax Return Services At Affordable Prices Weaccountax Is A Leading Accountancy Firm For Financial Services In Income Tax Return Tax Return Income Tax

Property Tax Appeal 3 Things You Must Do When Filing Your Appeal